Real Estate

Unlock Predictable Income with AI Rent Forecasting for Landlords

August 25, 2025

BLOG

Staff Augmentation, Project Outsourcing, or a Dedicated Team? How to Scale Faster With the Right Model

Choosing the right engagement model: outsourcing, staff augmentation, or dedicated teams: can make or break a software project. This article breaks down the strengths, risks, and use cases of each model with real-world examples. You’ll also learn how businesses evolve from project outsourcing to staff augmentation and finally to dedicated teams, ensuring long-term ROI, scalability, and control.

The age-old system of rental income relies on intuition. Money comes in the form of rental income, some of it is spent on regular updates, while the rest lines the pocket. Hence, most landlords don't lose any sleep over the cash flow. However, the world is unpredictable. Everything seems fine till there is a missed payment, a plumbing issue, or a sudden tax hike.

The problem here is not the unexpected expenses; it is the lack of real-time visibility. You cannot possibly react in a timely manner to financial risks without a rental income forecast. However, like all other arenas, AI is here to uplift the real estate sector. And we have a solution to your lack of foresight in cash flow management.

If you don't believe us, simply read and ponder as we crack open the traditions and elevate rental cash flow management with AI-powered dashboards.

What is Rental Cash Flow?

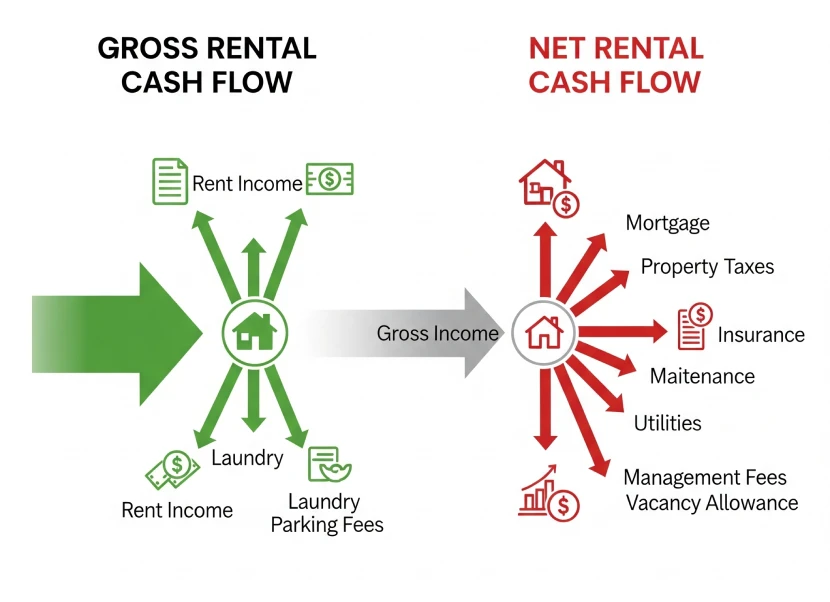

Rental cash flow is the money left over after all the property-related expenses have been paid off. The money that is left over after covering all costs, including maintenance, taxes, mortgage payments, insurance, and property management fees, is your actual rental income. In simple words, it is your profit; it is also called the net cash flow.

Gross cash flow, on the other hand, is the total amount of money you collect from your renters. It is the revenue potential of your property, but it does not reflect on its profitability.

Here's a simple way to think about it:

Gross Cash Flow = Total Rent Collected

Net Cash Flow = Gross Cash Flow − All Expenses

Why It Matters to Landlords and Investors

Rental cash flow is more than just a financial metric; it shows the viability of a property. A positive gross cash flow indicates the property not only pays for itself but also generates profit. As a landlord, it allows you to reinvest, cover emergencies, and even support your personal expenses.

As an investor, net cash flow matters more as it builds the portfolio. It is the most important metric for loan eligibility, acquisition decisions, and even exit strategies. A property with predictable cash flow is more valuable in the eyes of the system.

Ultimately, rental property cash flow determines how resilient your business is when the market shifts or tenant trends change. Hence, without proactive property management tools, you're practically flying blind.

The Limits of Manual Forecasting

You can track rent price projections for single units on a spreadsheet. But this system does not work for a diverse portfolio in the current erratic market. There are three major limitations in manual cash flow models as discussed below.

Inconsistent Data

Cash flow management for landlords requires keeping track of all kinds of data, including rents, maintenance logs, lease agreements, and expense records. The different kinds of data are stored in different systems or formats. Consolidating this data into one rental cash flow dashboard is a time-consuming process and one that is prone to errors.

Blind Spot

Without predictive analytics or smart finance tools, there is no way you can model your real estate business to manage unexpected costs. Whenever an emergency repair arises or insurance prices increase, you will be left blindsided. All due to reliance on manual cash flow models.

Absence of Real-Time Insights

The absence of real-time insights leaves you in a place where your only option is to react to the problem. It does not prepare you to prevent the problem from occurring altogether. Without live data and visual rental cash flow, you cannot spot patterns or anticipate issues to adjust to a proactive approach.

Manual Errors

A study revealed that 2% to 5% of spreadsheet formula cells contain mistakes. In real estate financing, these errors can result in missed notifications, misjudged predictions, and even thousands of dollars in lost revenue. By continuing to use a manual instead of opting for AI cash flow forecasting techniques, you are exposing your business to problems that automation can solve with a click.

Practical Applications for Landlords

Smart financial tools are not just fancy applications. They have real implications for the performance and success of your business. By turning raw data into timely and actionable insights, AI-powered dashboards bring practical benefits that make a real impact on operations.

Lease Expiration Forecasting

For the owner of a diverse portfolio of rental properties, it is impossible to keep track of all lease agreements. Apartment rent forecast systems take the guesswork out of tenant retention. It notifies you which leases are closer to expiry so you can send advance notice of upcoming renewals. It also allows time for outreach, rent adjustments, or marketing to reduce vacancy periods of your property.

Real-time Rent Roll Analysis

The rental cash flow dashboard has live payment tracking to help you gain a clear view of cash flow trends across your portfolio. With real-time analysis, you can instantly view what's been paid, what's due, and what's forecasted.

Automated Alerts

The automated alerts add an extra layer of protection by flagging irregularities. You will know instantly when a tenant misses a payment, maintenance costs exceed a set threshold, or cash dips below a target margin, smart systems flag it. These real-time warnings give you time to course-correct before small issues become major losses.

The Real-World Property Intelligence by MatrixTribe Technologies

At MatrixTribe Technologies, we don't just theorize about intelligent forecasting. Our perspective is built from years of experience deep in the data trenches of the real estate sector. With the level of experience and foresight our team holds, we can build AI-powered platforms that don't just analyze properties but help operate them as well.

Our engineering tribe is currently working on the technical development of a smart building system. The system will span both public and private real estate assets. So, when we say we have first-hand insights into the complexities of forecasting across diverse portfolios, we mean it.

We also have experience in developing market intelligence systems that can crawl thousands of listings. Our AI-driven models helped our client map price trends, tenant behavior, and rental gaps at a scale most landlords never get to see.

When we talk about predictive cash flow and rent forecasting, it's not hypothetical. It's built on years of experience integrating machine learning, NLP, and custom data pipelines into property tech that actually works in the field.

If you are someone who wants to move beyond reactive spreadsheets and into intelligent, portfolio-wide foresight, this is what that future looks like.

Frequently Asked Questions

Q. What is the formula for rent?

A. There's no single universal formula, but a common baseline calculation for monthly rent is:

Monthly Rent = (Annual Rent / 12 months)

or

Monthly Rent = (Total Property Value × Expected ROI) / 12

For example, if you want a 6% annual return on a $300,000 property:

($300,000 × 0.06) / 12 = $1,500 per month

This is often adjusted based on market demand, location, property features, and occupancy rates.

Q. How to properly calculate rent?

A. To calculate rent accurately, analyze nearby listings, factor in expenses like taxes and maintenance, and aim for positive cash flow. Include a 5–8% vacancy buffer and adjust for upgrades or amenities. If you have a diverse portfolio, then use tools like AI-based rent calculators to refine pricing by factoring in seasonality and demand, ensuring your rates are competitive, profitable, and aligned with market realities.

Q. What is the effective rent calculation?

A. Effective rent reflects the true average rent received after concessions, incentives, or promotional discounts. It's calculated as:

Effective Rent = (Total Rent Collected Over Lease Term) / (Number of Months in Lease)

For Example:

If you lease a unit at $2,000/month for 12 months but offer 1 month free:

Total Rent Collected = $2,000 × 11 = $22,000

Effective Rent = $22,000 / 12 = $1,833.33/month

This is a crucial metric in cash flow forecasting, as it reflects your real rental income, not just the face value of the lease.

Q. Can AI really predict late payments or lease breaks?

A. Yes, AI models trained on historical behavior patterns can flag risks early, such as tenants who delay rent or are likely to churn, enabling landlords to act before issues escalate.

Q. Is it worth the cost for small landlords to use AI forecasting tools?

A. Absolutely, even for portfolios with 5–10 units, minor mispricings or delayed payments add up. AI tools help improve NOI, reduce vacancy, and prevent surprises, making them a solid investment.

Q. Can I integrate forecasting tools with QuickBooks or my accounting system?

A. Yes, most modern cash flow platforms support integrations with accounting software like QuickBooks, Xero, or NetSuite, thus enabling seamless financial reporting and syncing of rent, expenses, and projections.

Q. Do these tools help with long-term planning or just short-term cash visibility?

A. They help with both. While real-time dashboards offer immediate visibility, forecasting tools can also simulate long-term scenarios, like interest rate hikes, investment returns, or lease policy changes.

Final Words

Cash flow forecasting isn't just about preventing shortfalls. It's about making faster, smarter, and more confident decisions. When you rely on guesswork, you miss early warning signs, overestimate stability, and quietly bleed revenue.

AI-powered forecasting changes that. It shifts you from reactive management to proactive control, helping you spot trends early, reduce financial surprises, and unlock new growth from the portfolio you already own.

In today's high-stakes rental market, clarity isn't just helpful. It's the edge that separates thriving portfolios from struggling ones.

Turn Uncertainty Into Insight with AI-Powered Forecasting

At Matrixtribe Technologies, we build AI dashboards that bring visibility, accuracy, and control to your rental finances. Don't wait for the next missed rent check or surprise repair bill. Contact us today and see how real-time forecasting tools can bring confidence back to your cash flow.

New Latest Article